Payroll Crack With License Key

Payroll is a vital aspect of any business and is often referred to as the lifeblood of a company if Payroll crack. It is the process of calculating and distributing the salaries, wages, bonuses, and deductions for a company’s employees, and it requires a significant amount of time, effort, and expertise.

From calculating and withholding taxes to issuing paychecks and managing benefits, payroll can be a complex and challenging task.

Payroll Crack Overview

But despite its difficulties, payroll is also a critical component of human resources management and plays a crucial role in the financial stability and overall well-being of employees.

In this article, we will look at the five features of the payroll system:

Calculations of Pay and Deductions

A payroll system should have the capability to automatically calculate pay and deductions based on various factors such as hours worked, salary, bonuses, and tax withholdings.

It should also be able to calculate deductions such as Social Security and Medicare taxes, federal and state income taxes, and other deductions like 401(k) contributions and health insurance premiums.

This ensures that employees receive the correct pay and that the company remains compliant with all tax laws.

Updater Key

- DJ38F3-DF93-ERF9E9

SERIAL KEY

- FD39FI-ERI9E9-ERJF9

Activation code

- FIE93JE-DFJEI-FJIEKD

Registration Key

- DJ3OH-X7ATR-9OS7L-WKT68-LIVXM-7NDGB

- UUZA8-ZZ0BR-PYTSU-3WV9A-7L451-7WQS9

Working Key

- F7E86E13-CDB6-4541-80C3-0BA0B8AF3E46

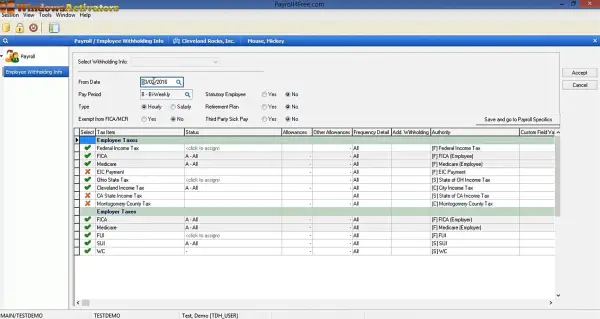

Tax Compliance

One of the critical features of a payroll system is tax compliance. It should be able to automatically calculate and withhold the correct amount of federal, state, and local taxes from employees’ paychecks.

The system should also be updated regularly to reflect changes in tax laws and regulations, ensuring the company remains in compliance.

Direct Deposits

Direct deposit is a feature that enables employees to receive their paychecks directly into their bank accounts, without the need for physical paychecks.

This feature can be set up for each employee, and the payroll system can automatically deposit their pay into the specified account on payday. This can save time and effort for both employees and the payroll department. Direct deposit also ensures that employees receive their pay on time, even if they are not physically present in the office.

Some of the benefits of direct deposit include:

- Convenience: Employees don’t need to physically go to the bank to deposit their paychecks.

- Time-saving: Direct deposit eliminates the need for physical paychecks, reducing the time it takes to process payroll.

- Improved cash flow: Direct deposit ensures that employees receive their pay on time, which can improve their financial stability and overall well-being.

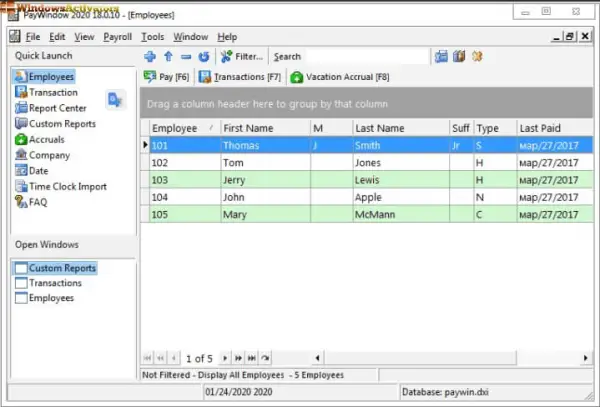

Record Keeping

Record keeping is an important aspect of payroll management, as it helps ensure that all payroll transactions are accurate and compliant with tax laws and regulations.

A payroll system should be able to maintain accurate records of employee pay, taxes, and benefits, and make this information easily accessible for auditing and reporting purposes.

It’s some features include:

- Accurate reporting: Accurate payroll records are essential for generating various reports, such as pay stubs and year-end summaries.

- Improved decision-making: Accurate payroll records provide management with valuable information on payroll costs, which can help with budgeting and decision-making.

Reporting

Reporting is a crucial feature of a payroll system, as it provides valuable information to both employees and management.

The system should be able to generate various reports, such as pay stubs, tax forms, and year-end summaries.

These reports can help employees keep track of their pay and taxes, and they can also provide management with important information on payroll costs and compliance with tax laws.

Final Thoughts

To wrap up, payroll is a crucial aspect of any business that requires careful management and attention to detail. From calculating taxes to issuing paychecks and managing benefits, payroll can be complex, but it’s also essential for the financial stability and well-being of employees.

HOW TO DOWNLOAD CRACK?

Click on the given crack link if you download it so this is a risk to your computer or laptop, and whatever device you are installing this so it may affect your device:

DOWNLOAD CRACK

By choosing the right payroll system and understanding the key features and benefits, businesses can simplify the payroll process, improve efficiency, and provide their employees with the support they need.